Content

Marketing FOR Subprime lenders

Only a few short decades ago, subprime lenders relied heavily on word of mouth, printed fliers, and costly television or magazine ad spend for customer acquisition. But more recently, digital marketing strategies have overtaken the subprime lending industry.

Specifically, content marketing has become a vital part of nearly every thriving subprime lender’s digital marketing plan. Content marketing sets your subprime lending company up for success by positioning your brand with authority. You become an expert resource to potential customers through subprime lenders content marketing, ultimately impacting your subprime lending company’s long-term growth.

Get A Proposal

Turn leads into customers and get started today. We’ve partnered with finance and real estate brands around the globe with digital marketing campaigns, including SEO, content creation, lead generation, and beyond. Get results with the pros in your niche – we’re not a generic agency that works with everyone.

What Do Our Subprime Lender Content Marketing Solutions Include?

Gone are the days of wishing upon a shooting star or hedging your bets by blowing your entire marketing budget on paid advertisements. Because when you build SEO-driven content marketing for subprime lenders, it makes your growth scalable and sustainable.

At SJ Digital Solutions, we provide marketing strategies for subprime lenders that provide you with a sense of relief and security. Our clients describe our work as fast, flawless, courteous, and excellent.

Imagine what it’ll feel like when you go from stressed-out trying to DIY your content and gather up all the latest SEO hacks from online “gurus” to feeling relieved because you know a team of experts is doing the SEO optimization on your content. Not only that, but you get to feel confident with your content because a team of knowledgeable professionals writes it.

When you choose to invest in content marketing strategies for your organization, you get:

- Competitor Analysis

- Optimization with Ahrefs and SurferSEO

- Grammarly Premium Checked & Plagiarism Pass

- Authoritative External Links and Relevant Internal Links

- CTAs to Drive Leads, Traffic, and Revenue to Your Offerings

- Style and Tone of Your Choosing

- 1 Round of Revisions

- Uploaded to a Platform of Your Choice, if Desired

- Custom Google Drive Collaboration

- Monthly Analytics Report

Move over Whole Foods because content writing and content marketing are organic too! As a matter of fact, 51% of all website traffic comes from organic searches to value-add content. This means that when you create content, it has the potential to skyrocket your revenue and organically drive new leads to your organization.

Want to see our work in action?

What Kind of Content Can You Create as Your Subprime Lender Marketing Strategy?

Subprime loan companies like yours provide customers with financial services that improve their lives.

You help newlyweds with a large student loan debt get a mortgage on their first home together. You help a young single mother get a small business loan after bankruptcy to start her new business out of her home and positively impact future generations. You help divorcees find housing when their credit was trashed in a divorce.

You’re in the business of making dreams come true, one dollar at a time.

So when you’re creating content for financial content marketing, it’s vital for you to include a human element. Your customers want you to connect with them before they hand over their hard-earned money.

And connection often takes time, attention, and communication.

As a subprime lender creating helpful content, imagine how you can best connect with your ideal customers.

For instance, what would you say to describe step-by-step how to open a new savings account to your grandmother? What do you wish a financial mentor had told you as a young person entering the workforce with a large debt load from college?

Utilize your subprime lender content marketing to share WHY it’s important to take or avoid specific actions.

Include “How to” information and helpful tips, hints, and strategies that make it easy for your client to take the next step with you on the financial content you create. For more information on this, check out our complimentary e-book, where we share our top tips for creating content that organically drives traffic to your website.

Now let’s discuss some of the best ways to create content for financial content marketing:

Email Marketing

It’s no secret that hundreds of millions of people use email daily– studies show that nearly 100% of users don’t skip a day when checking their email inbox. Some users have been known to check their email 15-20 times per day!*

So it’s easy to see why email is where you get to build deeper relationships with your audience, stay in touch and top of mind, make special offers, and ultimately sell to your list.

When mapping out a subprime lending marketing strategy, include email marketing– especially through your list segmentation. List segmentation is where you tag certain groups within your database by their interests and consumer behavior.

When you segment your list correctly, content marketing for subprime lending becomes a breeze because you know what offers to send to each portion of your master list.

*According to Opt-In Monster.

Financial Planning Podcasts

When you build out your content marketing for subprime loan providers, you want to consider short-form and long-form content.

A podcast is a great way to get long-form content to your future customers. And although podcasts may seem saturated, the truth is that 9/10 podcasts don’t make it past the 3rd episode. So if you got into your podcast with a plan, you’re primed to make an impact– especially in the financial realm.

Everybody has finances to manage and a future to plan for, so creating a financial planning podcast as a part of your subprime lender marketing strategy will create an almost instant audience for you.

Be consistent, simplify complicated financial terms and matters, help your audience identify manageable financial milestones, and interview interesting people. Then your financial planning podcast will be well on its way to success!

Remember to transcribe your podcast episodes to use portions for social media captions or to help you write blog posts for your website. Repurpose sound bites for social media posts too. Finally, you send an email to your list each time a new podcast is released so your audience can access other free content.

Articles

Writing articles to feature on your website or submitting them to an online publication can help your potential clients find you online. They give you exposure to new audiences and overall provide value.

Articles are written to inform and educate. They’re considered a top-of-funnel marketing strategy, but remember that written pieces can powerfully connect you to your readers.

Imagine how seen, known, and understood a potential customer feels when you answer the questions that have been living rent-free in their head before they’ve even spoken with you.

Articles can build trust through the information freely given.

Downloadable Worksheets & Checklists

By now, you might be curious about how to get someone to subscribe to your email list. One of the easiest ways to provide free value through your subprime lenders content marketing is to develop downloadable worksheets and checklists like this awesome one we created called The Ultimate SEO Checklist. After all, who doesn’t love a good rush of endorphins from completing a list?!

Giving a piece of downloadable content in exchange for your audience member’s email address is often called a freebie, opt-in, or lead magnet. This is because the content is accessible to the consumer at no cost, opts them onto your list, and your content attracts them as a lead.

A worksheet or checklist need NOT be complicated. Something simple is best because the most important thing is that your freebie is compelling. Your audience needs to get results or a quick win from your content so that it feels like an even exchange– they get to take a step forward, and you gain their email address to send them future content.

Infographics

For consumers who are more visual learners, infographics serve to share important information, statistics, trends, and other relevant facts.

Infographics can break up large blocks of text and make them more digestible for the reader, so be sure to include them in your subprime lender marketing strategy.

Interactive Financial Calculators

When a consumer desires help from your subprime lending company, they want help with their specific situation.

For example, given the recent shifts in the housing market and the increase in interest rates, a couple may be interested in utilizing an online mortgage calculator to see if they can afford the dream home they’ve had their eye on.

Or perhaps a recent college grad with student loan debt is looking for reliable transportation to their new job. Including a auto loan calculator on your subprime loan company’s website could draw in customers like this seeking a solution to their questions. When you provide them with an interactive financial calculator, you’re meeting your customer’s needs in a personalized way. This helps build the know, like, and trust factor.

Additional Content Marketing Services We Offer For Subprime Lenders

In addition to these services, we offer:

Our Framework for Subprime Loan Provider Content Marketing

VISION

When you’re ready to have your financial brand grow through your content, we’re here to help you become more visible as an authority in your niche by creating your content backed by our three pillars below.

Our goals when implementing content marketing strategies for subprime lenders are to increase traffic, leads, and conversions for your organization. Allow us to operate in our areas of expertise by creating content that converts and optimizes your content with SEO.

When you take these two things off your plate, you can focus your time, energy, and resources on YOUR areas of expertise. It’s time to stop stressing and overburdening your internal team. Outsource this area of your business to us and get it right the first time. Because not only are we experts at content and SEO, we’re experts in the finance niche.

STRATEGY

You deserve to experience what it’s like to work with us because we understand the big picture. A piece of subprime lending content marketing is never one and done.

We create content that connects to your audience, your other content, and your overall sales and marketing goals.

EXECUTION

Allow us to implement your strategy by taking massive action with one or multiple of our packages.

It’s time for you to save hours spent researching, crafting, ideating, and guessing because when it comes to your content ranking, it’s not just about your great ideas. It’s about how you execute your ideas.

ANALYTICS

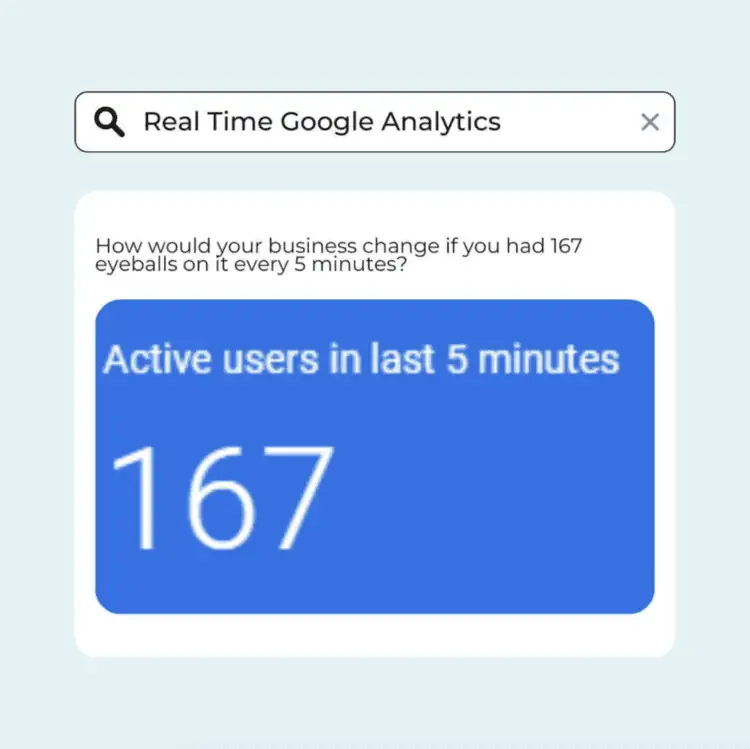

We constantly keep a pulse on what’s going on data-wise in the subprime lending industry and keep you informed too.

We do this by regularly monitoring analytics through Google Analytics and Google Search Console, sending reports to our clients, taking action based on the data, and keeping content fresh and updated over time.

We’d never claim to be experts, but we are aware of the strict compliance standards within the financial industry. Moreover, refreshing content is crucial since numbers, regulations, etc., change in the financial services industry sometimes yearly.

Get A Proposal

Turn leads into customers and get started today. We’ve partnered with finance and real estate brands around the globe with digital marketing campaigns, including SEO, content creation, lead generation, and beyond. Get results with the pros in your niche – we’re not a generic agency that works with everyone.

What’s the Benefit of Content Marketing for Subprime Lenders?

Content marketing has many benefits for financial services, such as increased web traffic, a better user experience, higher conversions, etc.

1. Increase Traffic To Your Website

When your content is recognized by Google as valuable and thereby ranks on the first page, you gain visibility in your niche. In addition, people who click on and consume your content see you as a go-to resource for solutions in the subprime lending industry, increasing traffic to your website.

2. Create a better user experience to increase conversions

There’s a common misconception that people only want cold, hard facts when in actuality, the adage holds true:

“People don’t care about how much you know until they know how much you care.”

Creating a thoughtful user experience through helpful content will undoubtedly lead to increased conversions and impact the growth of your subprime lending company in the long run.

3. Lower your marketing costs

You’ve probably noticed how costly pay-per-click marketing is versus organically receiving traffic for free from Google.

Shifts like the iOS updates, ever-changing algorithms, political climate, and current economic conditions all make spending money on Facebook and other social media ads a considerable risk.

Instead, increase your organic reach and TIME and lower your marketing costs when you outsource your subprime lender content marketing. Content marketing has an incredibly high ROI because your content can drive hundreds of additional organic leads to your business.

SJ Digital Solutions Skyrockets Companies in the Subprime Lending Industry

It’s reported that the subprime lending industry has a market value of over $18 billion. This is why at SJ Digital Solutions, we believe content marketing for subprime lenders is critical. You deserve to experience what it’s like to stop chasing leads, decrease your stress, increase your time spent in your zone of genius, and watch as your conversions skyrocket.

It’s clear to see that subprime lending content marketing is critical for any marketing strategy for subprime lenders. So we are ready to help you create ranking content.

Let us help you make content marketing YOUR differentiating factor in the financial space.

Frequently asked questions

These are the most frequently asked questions we receive from subprime lenders when they want to kickstart their content marketing. So go ahead and take a quick skim + scroll to save yourself an email.

Q: What Is the Importance of Using Content Marketing for Subprime Lenders?

A: One word: Visibility. Your brand gets in front of new people daily with SEO-powered content marketing for subprime lenders.

When you allow us to create strategic, researched, and optimized content for your subprime lending company, you’ll see increased visibility, leading to more sales and conversions.

Q: How Much Content Writing Does a Subprime Lender Need?

A: The short answer? We recommend starting with at least 4 articles per month.

The longer answer: With content driving traffic to your products, services, and other offerings, you’ll soon see the conversions roll in. This is why we offer 3 solutions for you when outsourcing your content marketing strategies for subprime lenders to us. Click here for more details.

And if one of our content creation packages isn’t calling your name, we respect that. So simply click here to shoot us an email to get a custom quote.

Q: How Long Does It Take To Produce Subprime Lender Website Content?

A: Based on which package you choose, we deliver a predetermined number of articles on your site monthly. Our packages go from as few as 4 articles per month up to 12 articles per month. Custom quotes are available upon request.

Q: Can I Expect Results From a Subprime Lending Content Marketing Service?

A: Absolutely. In about 3-6 months, you’ll see results from your subprime lending company’s content marketing strategies.

Keep in mind that content marketing is a long game. For example, an article we wrote for one of our clients published in March 2020 has received over 75,000 clicks and 1.44 million impressions in the last 16 months. {Psst. . .you’re next!}

Q: How Can Your Subprime Lending Company Get Started With Website Content Creation?

A: Easy—when you’re ready to build content that will make your financial brand visible to Google (Finally), click here to get started.