Email Marketing

FOR B2B LENDERS

You probably think your lending firm doesn’t need email marketing. Businesses need loans all the time, so email marketing isn’t necessary.

While it’s true businesses need loans often, they have hundreds if not thousands of options with today’s online lending opportunities.

So where does that leave you?

If you don’t have a solid plan for email marketing for B2B lenders, you could lose a large portion of your target audience to lenders that use DFY email marketing services for B2B lenders.

Email marketing is a direct message to your target audience, aka the people that want to hear from you. This differs from your social media audience. You may have a large social media following, but how many of them are interested in your services? Many click the ‘follow’ button without considering who they follow, so they aren’t a targeted lead.

To put it mildly, 1,000 followers on a social media site like Facebook isn’t nearly the same as 1,000 email subscribers.

Email open rates are around 17% for most industries, whereas social media reach, depending on the platform, can be 5% – 8%. That’s a big difference!

Get A Proposal

Turn leads into customers and get started today. We’ve partnered with B2B lenders around the globe with email marketing campaigns. Get results with the pros in your niche – we’re not a generic agency that works with everyone.

What Is Email Marketing for B2B Lenders?

Email marketing for B2B lenders keeps you in touch with your clients. It allows them to contact you personally and feel like they matter.

Email marketing strategies for B2B lenders allows you to educate, converse, and sell to your target audience. It includes timely emails with proven strategies that help increase customer engagement, conversion, and loyalty.

DFY email marketing services for B2B lenders know exactly what clients want to hear and how to convert them from leads to clients if they aren’t already. If they are already clients, email marketing keeps them informed and engaged, both of which are important to maintain your clientele.

So why consider an email services for B2B lenders?

Here are a few reasons:

- Promote new products and services

- Connect personally with your audience

- Make your clients feel like they matter, and they aren’t just a number

- Keep your clients engaged, so they don’t go to another lender

- Increase brand awareness

- Increase traffic to your blog or website

- Run A/B tests on subject lines and calls to action

Want to see our work in action?

B2B LENDING EMAIL STRATEGIES

At SJ Digital Solutions, we use top-notch email marketing strategies for B2B lenders to help you have high clickthrough and conversion rates. We have tried-and-true methods; we aren’t guessing or using you as a guinea pig.

Our founders have extensive experience in email marketing for B2B lenders and the tech industry, bringing their expertise together to create a powerful email marketing for B2B lenders strategy that sets you apart from the competition.

Here are some of the top strategies we use.

Personalize your message

Email marketing for B2B lenders will be lost on your audience if you don’t personalize your message. In other words, don’t throw out generic emails just to email your clients and leads. Instead, get personal; make your readers feel like you wrote the email specifically to them.

No one likes mass emails that make them feel like a number. So they’ll either not open it, or if they do, delete it immediately.

To personalize your message, include names, locations, and specifics about your readers, so they get warm fuzzy feelings when reading your email.

Educate new customers

Don’t assume everyone reading your emails knows everything or anything about your lending products. Welcome and educate them, but not in a salesy way.

Make your emails feel informative, empowering, and educational. This will naturally lead to lead conversion because your readers will feel like you are the industry expert and you care about them.

Your emails will help them make robust decisions about their lending needs, and they’ll turn to you because you’ve leveraged yourself as the industry leader.

Split test your email content

Sometimes email marketing for B2B lenders is a bit of trial and error. This isn’t a bad thing, though!

A split test means you send one part of your target audience one type of email and the other part another type. You then analyze which email had the best results. This can help determine how to move forward with your email marketing for B2B lenders strategies.

Why waste time on emails that don’t work?

Send alerts and notifications

Newsworthy tidbits, alerts about the economy, or notifications about lending services are all great reasons to email your client base. When you use email marketing for B2B lenders, you have your list on ‘speed dial’ and can send the message in real-time.

This eliminates the risk of delayed reactions and letting other lenders get the business because they beat you to the keyboard.

Automate your email campaigns

Automating your email campaigns ensures your emails get out on time with no effort. As a busy lending professional, you don’t have time to manually handle email marketing for B2B lenders. Automating it reduces the risk of missed opportunities and puts your email campaigns on a schedule that works best for your audience.

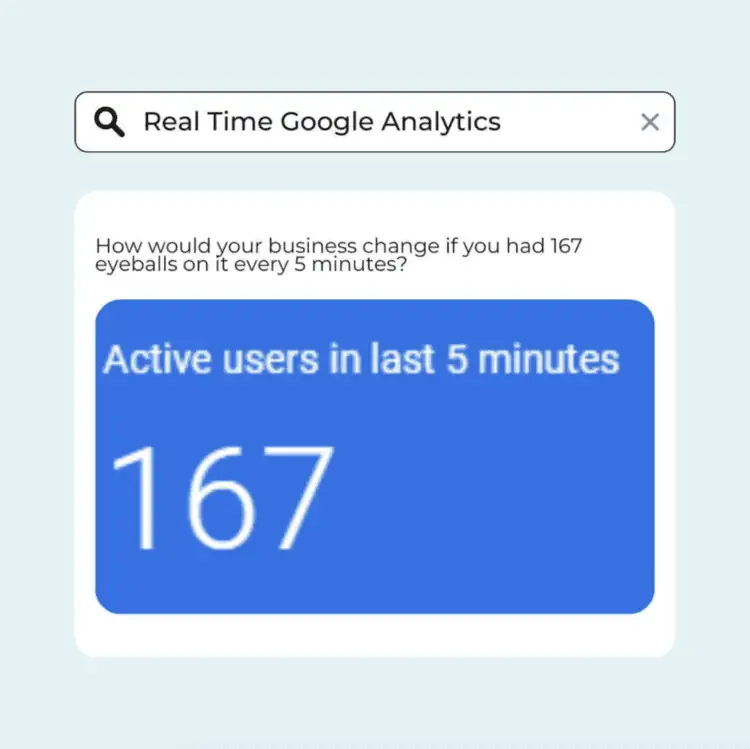

Track your metrics

Email marketing for B2B lenders isn’t a one-size-fits-all approach. Instead, you need a strategy tailored to your needs. In addition, you must understand and use email analytics to ensure your emails have the most significant reach.

Some of the most important metrics to consider include the following:

- Clickthrough rate – The clickthrough rate helps you determine the emails’ effectiveness by measuring the number of clicks per delivered email. This is the easiest metric to use to determine how your emails perform.

- Conversion rate – Your email marketing for B2B lenders should include calls to action. For example, to determine your CTAs’ effectiveness, you can determine your conversion rate or how many people follow the CTA and do what you ask, such as completing a form or applying for a loan.

- Bounce rate – You want your bounce rate as low as possible with email marketing for B2B lenders. A bounce rate measures the percentage of emails that didn’t reach the intended audience. This could be because of bad email addresses, server issues, or closed email accounts.

Use data to build better segments

The data you get from your metrics should help you build better segments. For example, if your B2B lending email strategies aren’t converting as well as you hoped, or your clickthrough rate is low, you can try new strategies.

Return to the drawing board and do more A/B testing to determine which strategies yield the greatest results.

Benefits of Email Marketing for B2B Lenders

Email marketing for B2B lenders has many benefits. Here are the top benefits of DFY email marketing services for B2B lenders.

Help customers access their account information

Email marketing for B2B lenders educates your customers on basic things, like accessing their account information. It’s amazing how many people don’t know the full extent of what their lender offers.

By using email marketing strategies for B2B lenders, you stay in contact with your customers and remind them of all your services and benefits.

Improve the customer experience by making it easier for them to receive financial information on the go

41.6% of emails are opened on a mobile device, proving that your customers are doing business on the go. So when you email your customers at the right times, they will have the information they need to access their accounts.

Improve retention and loyalty

Email marketing for B2B lenders helps you stay in contact with your customers. With fewer people walking into brick-and-mortar lenders today, B2B lending email strategies are essential. It’s the tradeoff for a personal greeting and smile when they enter the door.

When you email your customers, you remind them that you care about them and can answer any questions or concerns. It’s also a chance to remind them of new services or promotions and make customers more loyal because you are constantly ‘in their face.’

Share announcements and promotions

There’s no better way to share announcements or promotions than via a timely email. DFY email marketing services for B2B lenders offer timely email distribution when your demographics benefit from it the most. As a result, your offers will reach them when they’re most likely to act, turning your emails into conversions.

Build relationships with customers

Customers like personal relationships. Unfortunately, building that relationship is hard if you run an online lending service because you never see your customers.

Email marketing for B2B lenders develops that relationship and gives customers a channel to reach you should they need more support.

Email Marketing B2B Lender Tips

Onboard new customers

Email marketing for B2B lenders offers an excellent opportunity to onboard new customers. Applying for a new loan or using lender services for the first time can be overwhelming. Using your email platform to welcome them, offer tips and support, and give reasons to use your services is a great way to increase customer loyalty.

Send a welcome email

A welcome email helps customers feel like a person and not a number. You make them understand that you care about each customer and are here for their questions or concerns.

Welcome emails are a chance to thank customers for choosing your lending firm and increase customer engagement, which increases customer loyalty.

Think about it. Would you be more loyal to a lender that immediately welcomed you and kept in touch via email with news, promos, and check-ins, or one that took your money and never said a word?

It’s an easy answer for anyone.

Keep them in the loop with updates/changes

Updates and changes need to be pushed out to customers in a timely manner. Missing the opportunity could mean losing customers.

Whether you have policy changes, exciting new products, or a new way to handle accounts, letting customers know immediately will increase customer satisfaction and loyalty.

Segment your customers

Chances are you’ll have customers from different demographics with different lending needs. Segmenting your customers into categories ensures you send the right emails to those who need them.

For example, if you have a group of subscribers that own small businesses, and a group of large business owners, they have different financial needs. Segmenting them into categories ensures you send the right marketing material to the right group, increasing your conversion rates.

Provide Value every time

Don’t waste your customers’ time! Email marketing for B2B lenders must provide value in every email sent. Some emails will have a sales pitch, but combine that with education or another value-added service, and it won’t make your customers feel like you’re using email marketing strategies for B2B lenders to increase your profits.

Build credibility with your brand

Email marketing for B2B lenders must be consistent throughout all messages. Don’t confuse customers by mixing up your logos, colors, or messages. Instead, keep everything constant to build credibility and visibility for your brand.

Additional Services We Offer

For B2B Lenders

In addition to these services, we offer:

Our Framework for Email Marketing for B2B Lenders

VISION

SJ Digital Solutions uses a unique strategy to help you increase your customer base using email marketing for B2B lenders. First, we do the research. We learn about your business, its operation, brand messaging, and vision.

SJ Digital Solutions never uses cookie-cutter procedures. Instead, we tailor our email marketing for B2B lenders to your company’s needs after getting to know more about its processes, goals, and visions. We know what will work and what won’t, so we help you understand the best email strategy for the best results based on the information you provide.

STRATEGY

With SJ Digital Solutions, your email marketing strategy will be exclusive, helping you increase your clickthrough and conversion rates.

You don’t have to worry about doing what your competitors are doing or doing less than they do. Our strategy is tried-and-true and is based on both founders’ experience in the B2B lending and marketing industries to provide clients with real results.

With your information, we’ll create an email strategy that welcomes, educates, and converts customers.

EXECUTION

After creating our strategy, our experts create carefully crafted content to convert your readers into customers. Then, we work closely with you to determine the dates you want emails automatically sent and put our strategy to work.

You don’t have to worry about bringing on another staff member to handle email marketing. Outsourcing your email marketing for B2B lenders needs to SJ Digital Solutions is a cost and time-effective method to increase your customer base and profits.

ANALYTICS

No B2B lender email marketing services will be effective without analytics. For example, how would you know your clickthrough or conversion rates?

Without analytics, you’re wasting your time. Fortunately, at SJ Digital Solutions, it’s a part of our package. We immediately analyze the results of your email marketing campaigns, discuss them with you, and, if necessary, create new strategies.

Get A Proposal

Turn leads into customers and get started today. We’ve partnered with lenders around the globe with email marketing campaigns. Get results with the pros in your niche – we’re not a generic agency that works with everyone.

SJ Digital Solutions Skyrockets Companies in the B2B

Lending Industry

At SJ Digital Solutions, we believe email marketing for B2B lenders is critical. You deserve to experience what it’s like to stop chasing leads, decrease your stress, increase your time in your zone of genius, and watch your conversions skyrocket.

It’s clear to see that email marketing for B2B lenders is critical for any marketing strategy for lenders. So we are ready to help you increase your conversions.

Frequently asked questions

Here are the most frequently asked questions we receive from clients in the lending industry when they want to kickstart their email marketing campaigns.

Q: Can I expect results from your email marketing service for B2B lenders?

A: Of course, you can expect results from our email marketing service for B2B lenders. But we can’t tell you when or how much. Each email marketing strategy is carefully crafted based on your company’s needs, and we follow up on all analytics to ensure we’re on the right track.

Q: How to measure email marketing for B2B lenders?

A: There are many ways to measure email marketing for B2B lenders results, but clickthrough and conversion rates are the most common. These rates tell you how many people click on the links provided in the email and how many follow your call-to-action.

Q: Why is email the best way to communicate with your lending clients?

A: Over half of the global population uses email, with 4.37 billion email users expected in 2023. Email is timely, user-friendly, and a great way to converse with hundreds or thousands of customers at a time. It’s time and cost-effective; when done right, email marketing for B2B lenders can increase your bottom line.